Tax Havens Enact “Economic Substance” Legislation Post EU Sanctions

Reacting to threatened sanctions from the European Union (EU) (see March 12th report), tax havens have already enacted “economic substance” legislation locally. This will have a direct impact on how foreign individuals should structure their investment in the U.S.

Zero or low-tax jurisdictions, such as the British Virgin Islands (BVI), have long served as locations for offshore holding companies. In regard to U.S. real estate, a foreign individual could use a holding company in a jurisdiction such as the BVI to help “block” U.S. estate tax which only applies to individuals, not corporations. This “BVI Blocker” is a powerful tool considering nonresident alien individuals holding U.S. situs assets (e.g., U.S. real estate, U.S. stock) can be subject to a 40% U.S. estate tax with only a $60,000 exemption (as opposed to the $11.4M exemption in 2019 for U.S. tax residents).

The annual operating cost to achieve “economic substance” may not outweigh avoiding U.S. estate tax.

Economic Substance

Under the British Virgin Islands Economic Substance Act of 2018, economic substance is met when:

(a) the relevant activity is directed and managed in the Virgin Islands;

(b) having regard to the nature and scale of the relevant activity;

(i) there are an adequate number of suitably qualified employees in relation to that activity who are physically present in the Virgin Islands;

(ii) there is adequate expenditure incurred in the Virgin Islands;

(iii) there are physical offices or premises as may be appropriate for the core income-generating activities; and

(iv) where the relevant activity is intellectual property business and requires the use of specific equipment, that equipment is located in the Virgin Islands.

Holding Companies

A pure equity holding entity, which carries on no relevant activity other than holding equity participations in other entities and earning dividends and capital gains, has adequate substance if it:

(a) complies with its statutory obligations under the BVI Business Companies Act, 2004 or the Limited Partnership Act, 2017 (whichever is relevant);

(b) has adequate employees and premises for holding equitable interests or shares and, where it manages those equitable interests or shares, has adequate employees and premises for carrying out that management.

Effective Immediately

The BVI enacted substance requirements on January 2, 2019, effective January 1, 2019.

The Cayman Islands enacted substance requirements on December 17, 2018, effective January 1, 2019.

Non-Cooperative Tax Jurisdictions

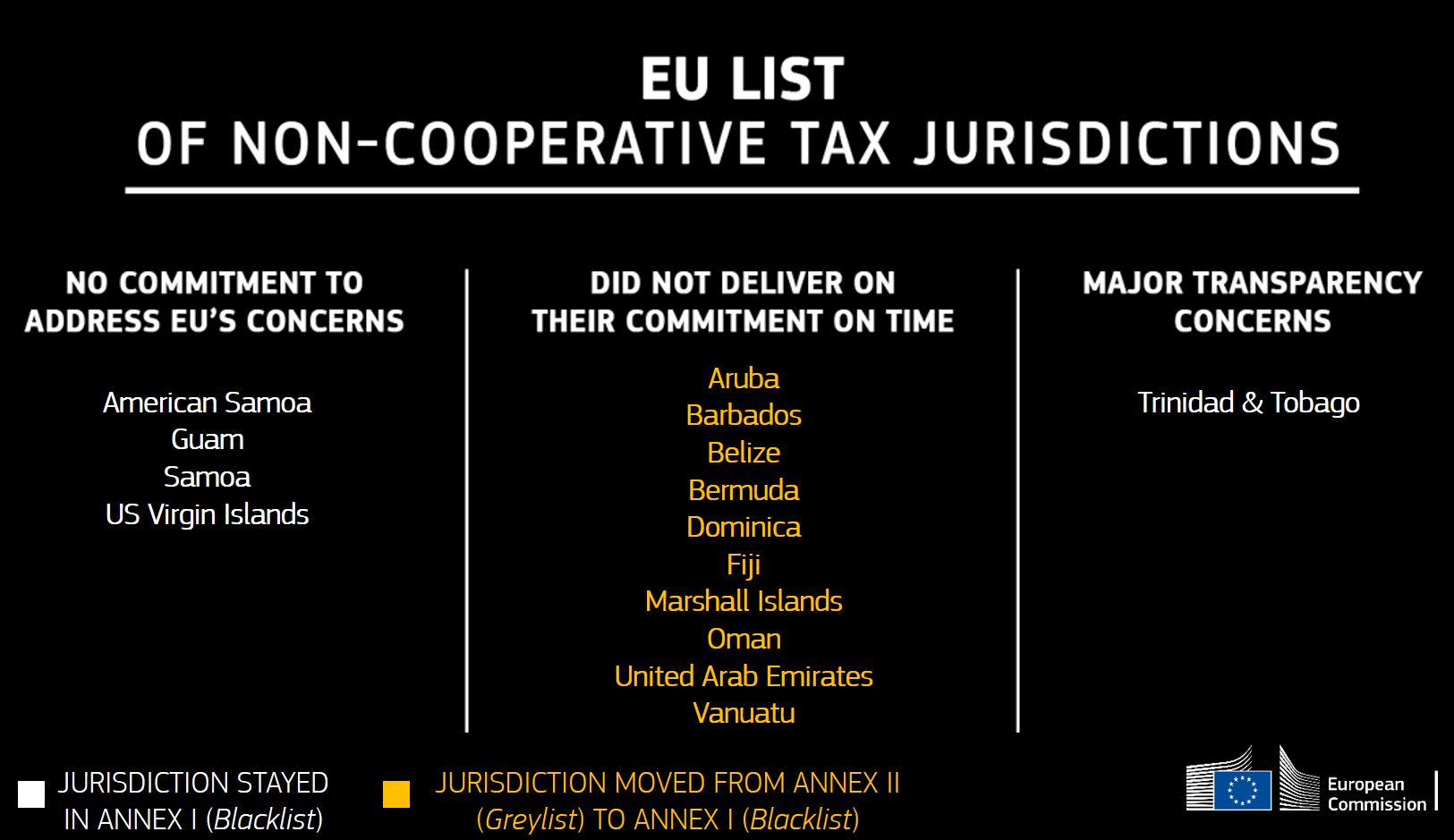

Following up on efforts originally outlined in 2016 to address tax abuse and unfair tax competition, the EU, liaising closely with the Organization for Economic Cooperation and Development (“OECD”), created a list of non-cooperative tax jurisdictions. The listing criteria includes: transparency, fair tax competition, and Base Erosion and Profit Shifting (“BEPS”) implementation.

During December 2017, the EU Member States agreed on the first EU list of non-cooperative tax jurisdictions. These jurisdictions were generally given until December 2018 to comply or face sanctions.

Possible EU Sanctions

- Deny funding from many EU programs (European Fund for Sustainable Development (EFSD), the European Fund for Strategic Investment (EFSI) and the External Lending Mandate (ELM))

- Sanctions to apply at a national level against the listed jurisdictions. These include measures such as increased monitoring and audits, withholding taxes, special documentation requirements and anti-abuse provisions

Reality of Economic Substance

Are small island nations able to immediately react with housing and infrastructure for what could be millions of people who may now be required to be physically present in such jurisdictions to fulfill the new “economic substance” requirements? Beyond infrastructure concerns, where will these millions of required qualified employees come from?

Proactive Partnering

International Tax Advisors, Inc. can help you understand how to react to this new legislation and maintain effective strategies to avoid overpaying tax. Call us today 786-762-4266